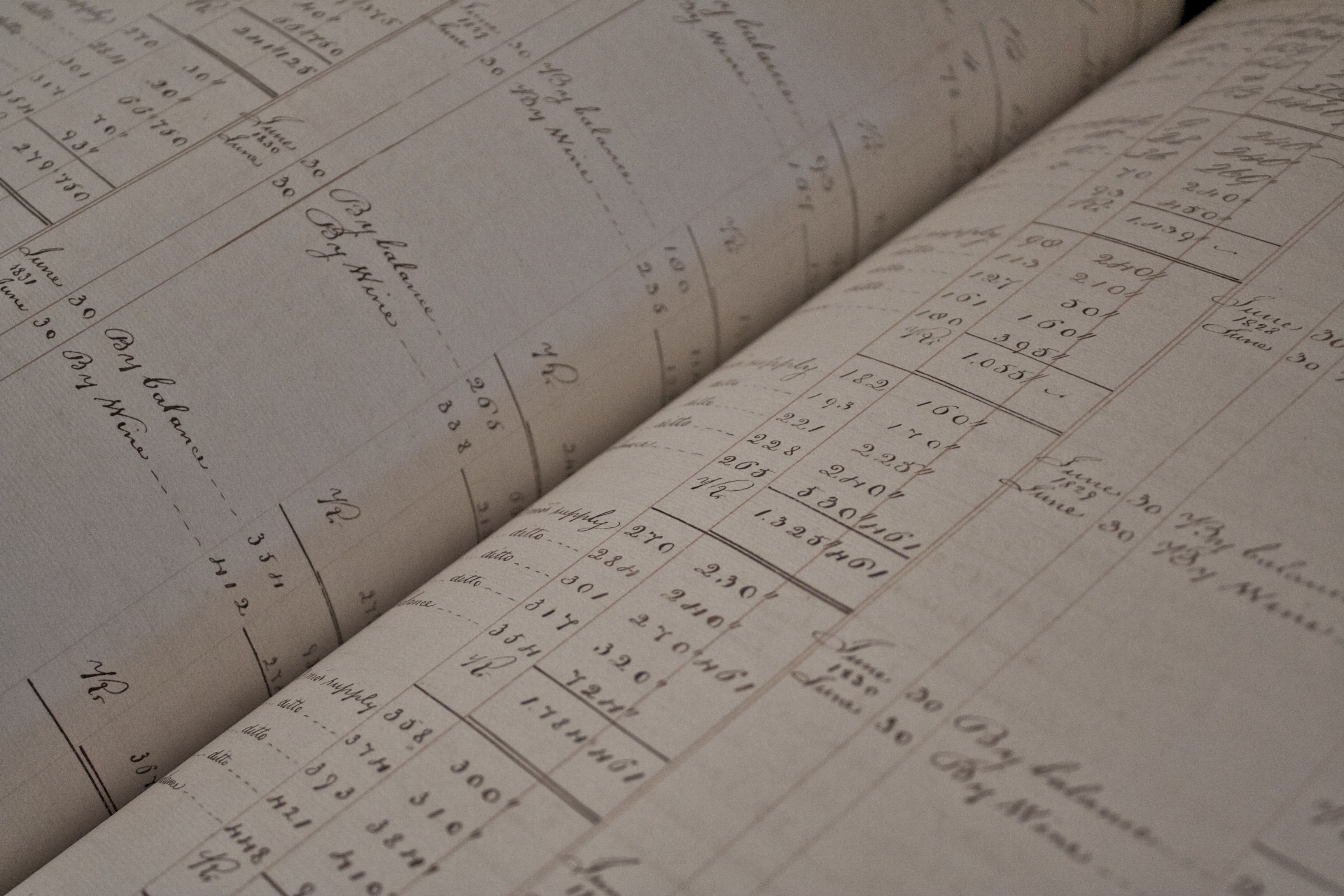

“Accounts Book”, Alexander Baxevanis, 2010, via Flickr

All business-owners should be familiar with the Generally Accepted Accounting Principles, (GAAP) and its purpose. Generally Accepted Accounting Principles are a collection of standards for accounting that serve to ensure consistency, clarity, and candor in accounting and financial reporting among businesses and government agencies. The GAAP is set by the Financial Accounting Standards Board (FASB) and the Governmental Accounting Standards Board (GASB). These are both non profit organizations that serve to demystify and standardize accounting, as well as safeguard against corruption, financial dishonesty, and fraud. All companies in the U.S. that publicly release financial documents are required by law to follow the GAAP.

What Is The Difference Between The GASB and The FASB?

While GASB and FASB standards come together to create the Generally Accepted Accounting Principles, the specific rules that each board creates apply to different organizations. GASB standards apply to accounting in government agencies, while FASB standards apply to public companies and non profit organizations. According to software company Accruent, “the primary difference is in the end users. For GASB, the end user is generally a taxpaying citizen. For FASB, it’s shareholders and/or investors who can benefit from standards-compliant reports.” The term “end user” refers simply to the person whom the standards will ultimately be relevant to, and apply to. Thus, the primary difference between GASB standards and FASB standards is their audience.

GAAP Framework

The GAAP Framework provides ten primary principles. According to the GAAP guide sheet provided by the Office of Justice Programs, they are as follows:

1. Principle of regularity: The organization’s accounting adhered to the standards of GAAP.

2. Principle of consistency: The organization’s accounting practices are consistent and comparable every reporting period.

3. Principle of sincerity: The organization’s accounting is accurate and correct depiction of the financials.

4. Principle of permanence of methods: The organization’s accounting practices are constant across financial periods.

5. Principle of non-compensation: All aspects of an organization’s performance are fully reported with no prospect of debt compensation.

6. Principle of prudence: The accounting entries are timely and realistic.

7. Principle of continuity: Short-term and long-term classifications of financial information are based on the idea the entity will remain in business.

8. Principle of periodicity: The accounting periods are regular, routine, and consistent.

9. Principle of materiality: Assets are valued at cost and all financial reports are based on truthful information.

10. Principle of utmost good faith: Every person involved in the accounting process is acting honestly.

Who Enforces The GAAP?

The FASB and the GASB create the GAAP, but who enforces GAAP? Two main agencies enforce GAAP, one of which being the FASB itself. The additional organization that enforces accordance is the Security and Exchange Commission (SEC.) Violating GAAP can result in multi-million dollar fines from the SEC, and generally harm the reputation and credibility of your business. Many private companies follow GAAP standards despite not being required to, as they are held in such high regard. According to the University of Chicago Booth School of Business, as of 2017 roughly one third of “medium-to-larger” private companies followed GAAP standards. Additionally, research from UChicago and the University of Illinois indicated that smaller and newer companies were more likely to follow GAAP in an effort to demonstrate their validity to investors. This exhibits the high-regard that GAAP standards are held in.

More Resources and Conclusion

Ultimately, knowledge of the purpose, enforcement, and fundamental basis behind the GAAP is essential for any business owner or accountant. The specific GAAP rules are extremely complex, but establishing familiarity with the agencies and practices behind the Generally Accepted Accounting Principles, as well as the ramifications for flouting them, is crucial. For more information about accounting and the various types of businesses, check out the Pitch Labs articles “What Is Accounting?”, “Understanding Corporations: A Detailed Guide” and “What is the Accounting Cycle?”

Leave a Reply